Getting a traditional loan or line of credit may be daunting if you’ve got poor credit. The association between loan applications is linear; therefore this scenario sounds counterintuitive. All isn’t lost, however. You can apply for a secured credit card even in the event that you have terrible credit. You are able to get a card issuer who is ready to supply you with a credit card after securing some deposit. The way it works is that you put a deposit to work as security in the event you don’t cover the balance. To apply for the card, you’ll give out the necessary identification and financial information. As the card issuer assesses your credit file, you’ll begin processing the collateral. Some card issuers also ask for your bank account info where they draw the deposit. Like every other provider, secured credit cards have some variation from the conventional charge card. Even though a secured credit card differs from the conventional ones, you will surely enjoy some perks.

![]() Mostly, several things could be detrimental to your credit report and tank your credit rating. In brief, credit repair is the process of enhancing your credit by deleting the adverse entries. In some instances, deleting the unwanted entries might be as straightforward as disputing the things with the bureaus. If you have any sort of concerns regarding where and ways to utilize go to website, you can call us at the web page. However, some cases like identity fraud and theft may present unprecedented challenges to you. The cause of which you are going to have to consider a repair company is that it will involve many legal measures. Additionally, fraud and identity theft usually entail a chain of well-choreographed criminal activities. Certainly, unraveling these chains can be an uphill task if you do it on your own. Though many people solved this matter independently, involving a company is usually the best approach. For this reason, you will sometimes have to hire a credit repair company to repair the elements. In any instance, you may finish the process independently or engage a credit repair firm.

Mostly, several things could be detrimental to your credit report and tank your credit rating. In brief, credit repair is the process of enhancing your credit by deleting the adverse entries. In some instances, deleting the unwanted entries might be as straightforward as disputing the things with the bureaus. If you have any sort of concerns regarding where and ways to utilize go to website, you can call us at the web page. However, some cases like identity fraud and theft may present unprecedented challenges to you. The cause of which you are going to have to consider a repair company is that it will involve many legal measures. Additionally, fraud and identity theft usually entail a chain of well-choreographed criminal activities. Certainly, unraveling these chains can be an uphill task if you do it on your own. Though many people solved this matter independently, involving a company is usually the best approach. For this reason, you will sometimes have to hire a credit repair company to repair the elements. In any instance, you may finish the process independently or engage a credit repair firm.

Several credit repair businesses are across the scene of credit repair. Considering the huge number of testimonials on the internet, Credit Rates finding the perfect one can be difficult. For nearly everyone, credit fix could be the treatment that they needed. Within this digitized age, you can search the world wide web to obtain the perfect repair options you have. At a glance, you will observe that picking from the hundreds of repair businesses on the internet can be hard. Besides, no one wants to invest money on a service which has no guaranteed results. Lexington Law, a respectable firm, has helped customers and has a track record of about two decades. No doubt, staying in business with this doesn’t prove a provider is good — but that’s not the situation. Legally, this company has turned out to maintain stringent Federal criteria in such a heavily-monitored scene. Moreover, Lexington law always keeps an impeccable success speed during recent years. Lexington Law has an incredibly excellent history and is certainly worth your consideration.

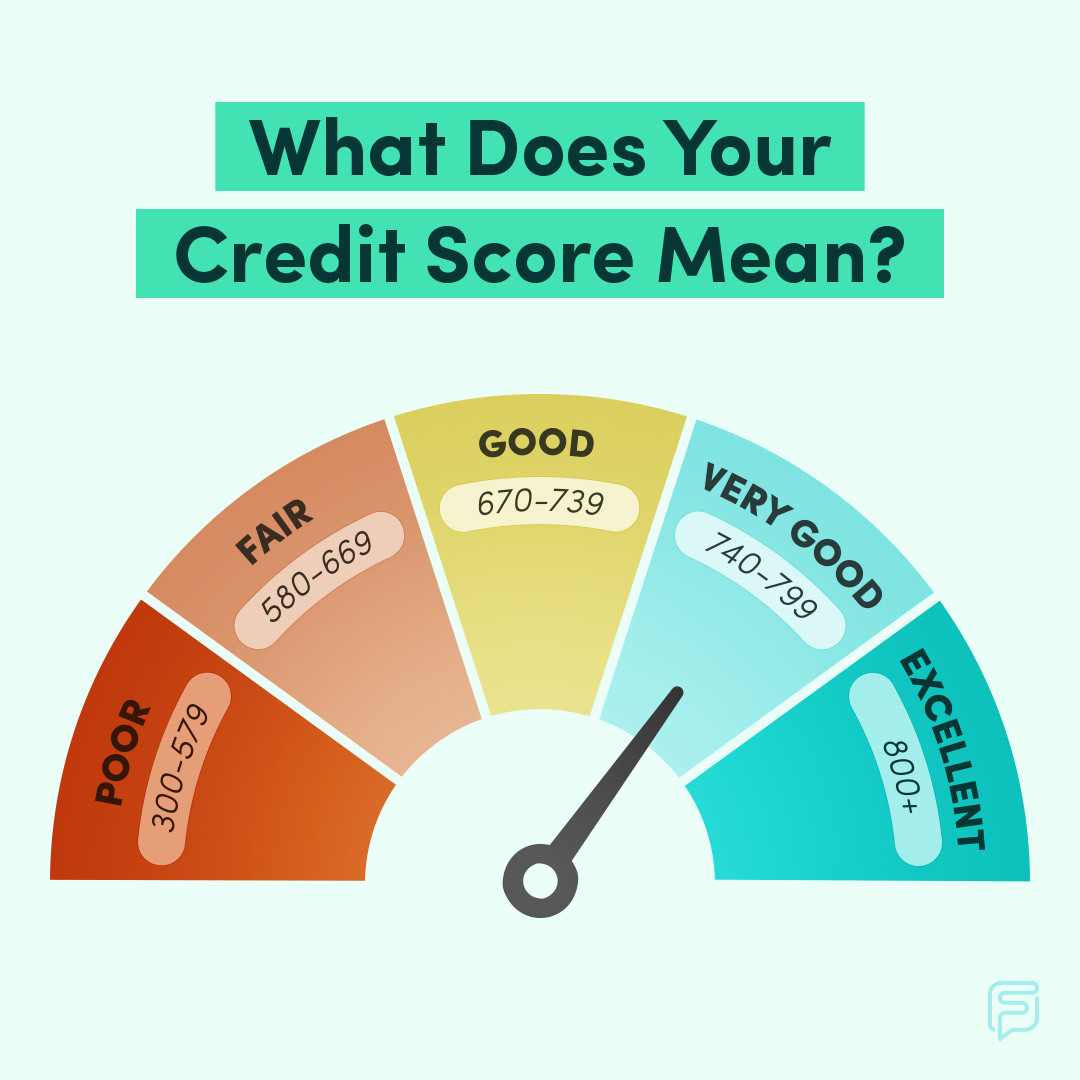

Your credit rating is a credit picture with which lenders use to judge your creditworthiness. Various loan issuers use customer-specific models to check their consumers’ credit reports. Additionally, credit card firms also use tailored strategies when assessing a credit report. When you have bad credit, loan issuers will less likely approve your program. In rare circumstances, your application may be successful, but you’ll pay high-interest prices and charges. For this reason, you should observe your finances to assist you avoid any issues. Checking your credit score is a powerful way of tracking your finances. Since the 3 data centers give customers a free credit report each year, you should maximize it. Retrieve your account and inspect the components that could damage your credit report. You should start working on the simple items before involving paralegals in taking away the complex ones. If you require a credit repair company, select one which matches your unique needs. Having great fiscal habits and assessing your report often would help keep you on top of your finances.

Primarily, several things could be detrimental to your credit report and tank your credit score. In a nutshell, credit repair is the practice of improving your credit by deleting the adverse entries. In some situations, it entails disputing the items with the various information centers. If this incident occurs, you might need to engage a credit repair company or agency. Since fixing fraud problems entails lots of legal complexities, you may have to engage a repair company. Moreover, this scenario is frequently accompanied by a very long chain of complicated criminal pursuits. Without a doubt, unraveling these chains may be an uphill task if you do it on your own. Though some consumers have solved identity theft on their own, a repair agency is often an perfect way. These processes demand the need to, sometimes, demand an honest credit repair company. Whichever the case, you might finish the repair procedure by yourself or involve a repair firm.

Primarily, several things could be detrimental to your credit report and tank your credit score. In a nutshell, credit repair is the practice of improving your credit by deleting the adverse entries. In some situations, it entails disputing the items with the various information centers. If this incident occurs, you might need to engage a credit repair company or agency. Since fixing fraud problems entails lots of legal complexities, you may have to engage a repair company. Moreover, this scenario is frequently accompanied by a very long chain of complicated criminal pursuits. Without a doubt, unraveling these chains may be an uphill task if you do it on your own. Though some consumers have solved identity theft on their own, a repair agency is often an perfect way. These processes demand the need to, sometimes, demand an honest credit repair company. Whichever the case, you might finish the repair procedure by yourself or involve a repair firm.